Contributed by 22V Research

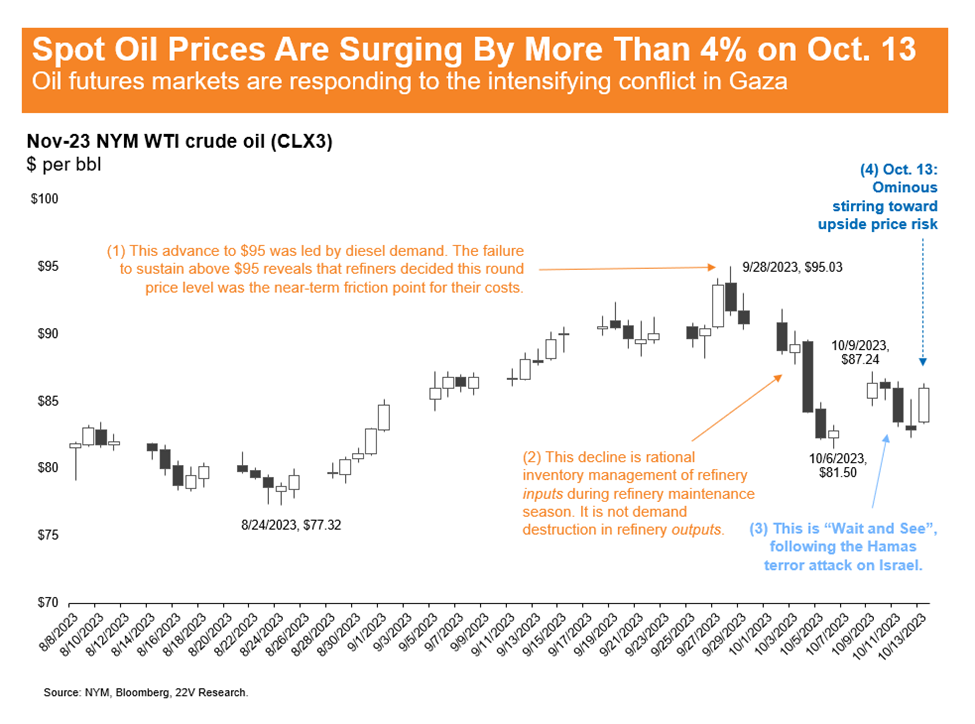

Oil futures prices have leapt by nearly $4 per barrel this morning in response to the intensifying conflict in Gaza.

A more ominous and more informative signal for investors is suddenly appearing in the oil options markets (charts below). The risk assessment implied by option prices for NYM WTI crude oil now shows: (1) a strong upside bias for realized physical price over the next few weeks and months, and (2) a signal of “high stress” that is incrementally worsening. Conditional probabilities are highly fluid and now in much more visible motion than over the past few days (i.e., rising volatility in implied volatility).

The path to here from last Friday

In the Nov-23 NYM crude oil options market, 25-delta skew favored the puts by about five vols at settlement on Friday, October 6, before Hamas attacked Israel.

The gravity and uncertainty of the evolving situation in Israel increased both upside and downside risks in oil prices. Options markets perceived and priced elevated but balanced two-way risk: the prompt 25-delta skew remarkably ranged between just +1 and +3 vols, at more or less normal implied volatilites, through the first four trading days after eruption of the conflict (Oct. 9-12) . As we have observed throughout this week, that is about as close as the oil options markets get to saying, “wait and see“.

This balanced posture has changed sharply overnight. The 25-delta skew as of 7:30am ET on Friday, Oct. 13, now favors the calls by more than 7 vols. More telling, implied vol in the calls at this tenor, relative to Oct. 6 settles, is +23 vols for the 25-deltas (55%) and +35 vols for the 10-deltas (69%).

The 25-delta strikes are at about $84.00/$90.50 in the Nov-23 and about $79.00/$95.50 in the Dec-23. The $100 strike is at about 5-delta in the Nov-23 and about 15-delta in the Dec-23.

We would emphasize that both upside and downside price risks are meaningful. Any price spikes might precipitate their own downdrafts, perhaps by accelerating successful diplomacy.